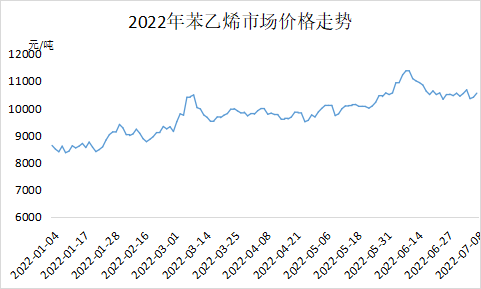

DomésticoestirenoOscilación de alta frecuencia do prezo. O prezo medio da recente transacción spot de gama alta en Jiangsu é de 10655 yuans/tonelada; a transacción de gama baixa é de 10440 yuans/tonelada; o diferencial entre a gama alta e a baixa é de 215 yuans/tonelada. Os prezos do petróleo cru e das materias primas caeron, a produción de estireno augas abaixo con beneficios reducidos, a baixa demanda do mercado negativo. Non obstante, os inventarios corporativos e as accións sociais seguen sendo baixos, a concentración de subministracións, os titulares de baixos niveis de consciencia, con algunhas transaccións de reposición reflectidas, non un repunte baixo. Suprimiuse o rango de caída do prezo spot, facendo que o estireno caese por debaixo do custo, a produción e as vendas das empresas de produción favorables, as empresas de produción poden operar para expandir o espazo, e a recente caída dos prezos corporativos ralentizouse, reducindo de novo a taxa de caída do estireno. O mercado actual do estireno está dominado pola oscilación de alta frecuencia, o final xeral lixeiramente cara abaixo, o descenso é limitado.

Lado da demanda

PS: as cotizacións do mercado nacional de PS remataron en declive, o rango de prezos na súa maioría entre 50 e 100 yuans/tonelada. Os futuros e os spreads spot do estireno recentes ampliáronse. A aversión ao risco no campo agravouse, e Taihua, Chi Mei, Greenan Prime e outros aparcamentos, os recortes de produción, o impacto do comezo do declive. A subministración escasa no campo, cunha actitude cautelosa para seguir o declive, o estancamento comercial no campo. O impacto dos recortes de produción, a contracción do inventario da industria.

EPS: os prezos nacionais do EPS subiron primeiro e despois baixaron. Os prezos do EPS repuntaron polo impacto dos prezos do estireno, os prezos do EPS mantéñense firmes, pero os prezos do petróleo baixaron e o estireno caeu en picado, os prezos do EPS baixaron. A aversión actual ao risco do mercado é obvia, a mentalidade empresarial é esperar e ver, a facturación xeral debilitouse.

A probabilidade dun descenso no lado dos custos redúcese e hai marxe para a recuperación. Co reinicio da recuperación da baía de Qingdao, xunto coa rendibilidade das empresas de estireno, reducíronse os recortes de produción para protexer os prezos, mentres que se espera que o subministro de estireno medre. Existe un pequeno aumento na demanda. Os inventarios das empresas de estireno e dos portos son baixos. E o mercado spot actual é baixo a curto prazo, a demanda spot non é un fundamento favorable. A próxima semana, o custo do mercado de estireno e o lado da oferta e a demanda do xogo, espérase que os prezos do mercado do leste da China poidan negociarse en 10300-10800 yuans/tonelada entre a oscilación.

Chemwin is a chemical raw material trading company in China, located in Shanghai Pudong New Area, with a network of ports, terminals, airports and railroad transportation, and with chemical and hazardous chemical warehouses in Shanghai, Guangzhou, Jiangyin, Dalian and Ningbo Zhoushan, China, storing more than 50,000 tons of chemical raw materials all year round, with sufficient supply, welcome to purchase and inquire. chemwin email: service@skychemwin.com whatsapp: 19117288062 Tel: +86 4008620777 +86 19117288062

Data de publicación: 13 de xullo de 2022