Desde a segunda metade do ano, produciuse unha desviación significativa na tendencia do n-butanol e os seus produtos relacionados, octanol e isobutanol. Ao entrar no cuarto trimestre, este fenómeno continuou e desencadeou unha serie de impactos posteriores, beneficiando indirectamente a demanda de n-butanol, proporcionando un apoio positivo para a súa transición dun declive unilateral a unha tendencia lateral.

Na nosa investigación e análise diaria do n-butanol, os produtos relacionados son indicadores de referencia clave. Entre os produtos relacionados existentes, o octanol e o isobutanol teñen un impacto especialmente significativo no n-butanol. Na segunda metade do ano, houbo unha diferenza de prezo significativa entre o octanol e o n-butanol, mentres que o isobutanol se mantivo consistentemente por riba do n-butanol. Este fenómeno tivo un impacto significativo na estrutura da oferta e a demanda de n-butanol e repercutiu na tendencia do n-butanol no cuarto trimestre.

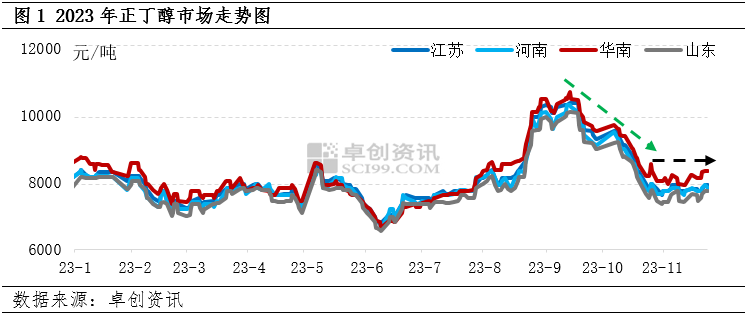

Desde o cuarto trimestre, baseándonos na monitorización dos datos operativos posteriores, descubrimos que a taxa de operación do maior produto posterior, o acrilato de butilo, diminuíu significativamente, o que levou a unha importante tendencia á baixa na demanda de n-butanol. Non obstante, nun contexto de aumento da oferta, o mercado espera que a cadea da industria do n-butanol acumule rapidamente inventario no futuro, o que desencadeará unha fermentación de sentimento baixista. Neste contexto, o mercado do n-butanol experimentou un descenso de máis de 2000 yuans/tonelada. Non obstante, as expectativas débiles na realidade atopáronse cunha forte realidade, e o rendemento real do mercado do n-butanol en novembro desviouse significativamente das expectativas anteriores. De feito, a pesar da falta dun alto apoio operativo do maior acrilato de butilo posterior, o aumento das taxas de operación doutros produtos posteriores, como o acetato de butilo e o DBP, é moi significativo, o que apoia a tendencia actual do n-butanol dun descenso unilateral a un funcionamento lateral. Ao peche do 27 de novembro, o prezo do n-butanol de Shandong estaba entre 7700 e 7800 yuans/tonelada, e leva tres semanas consecutivas negociándose de forma lateral preto deste nivel.

Existen múltiples interpretacións dos cambios no consumo augas abaixo por parte do mercado, pero o aumento das taxas de operación da industria de plastificantes DBP augas abaixo e a persistente situación de baixo inventario contradín o rendemento tradicional da industria durante a tempada baixa. Cremos que a ocorrencia do fenómeno anterior está estreitamente relacionada non só coa reposición gradual das augas abaixo, senón tamén cos produtos relacionados, e ten un impacto sostido no mercado de n-butanol.

A crecente diferenza de prezo entre o octanol e o n-butanol aumenta indirectamente a demanda de n-butanol

Nos últimos cinco anos (2018-2022), a diferenza de prezo media entre o octanol e o n-butanol foi de 1374 iuanes/tonelada. Cando esta diferenza de prezo supera este valor durante moito tempo, pode levar a que os dispositivos conmutables opten por aumentar a produción de octanol ou reducir a produción de n-butanol. Non obstante, desde 2023, esta diferenza de prezo continuou a ampliarse, alcanzando os 3000-4000 iuanes/tonelada no terceiro e cuarto trimestres. Esta diferenza de prezo extremadamente alta atraeu aos dispositivos conmutables a optar por producir n-butanol, afectando así á demanda de n-butanol.

Coa expansión da diferenza de prezo entre o octanol e o n-butanol, xurdiron fenómenos de substitución significativos no campo dos plastificantes augas abaixo. Aínda que a proporción de DBP no campo dos plastificantes non é significativa, a medida que a diferenza de prezo entre o octanol e o n-butanol se expande, a diferenza de prezo entre os plastificantes DBP e o octanol tamén está a medrar constantemente. Baseándose en consideracións de custo, algúns clientes finais aumentaron moderadamente o uso de DBP, aumentando indirectamente o consumo de n-butanol, mentres que a cantidade correspondente de plastificantes de octanol diminuíu.

O isobutanol segue a ser superior ao n-butanol, e parte da demanda desprázase cara ao n-butanol.

Desde o terceiro trimestre, a diferenza de prezo entre o n-butanol e o isobutanol experimentou cambios significativos. Co seu forte apoio fundamental, o isobutanol pasou gradualmente de ser máis baixo que o n-butanol a ser máis alto que o n-butanol como é habitual, e a diferenza de prezo entre os dous alcanzou un novo máximo nos últimos anos. Esta flutuación de prezos tivo un impacto significativo no consumo de isobutanol/n-butanol. A medida que a vantaxe de custos dos plastificantes de isobutanol diminúe, algúns clientes posteriores están a axustar as súas fórmulas de produción e a recorrer ao DBP con maiores vantaxes de custos. Desde o terceiro trimestre, varias fábricas de plastificantes de isobutanol no norte e leste da China experimentaron diferentes graos de descenso nas taxas de operación, e algunhas fábricas incluso se dedicaron á produción de plastificantes de n-butanol, o que impulsou indirectamente o consumo de n-butanol.

Data de publicación: 30 de novembro de 2023